Harness the liquidity pool of institutional providers:

Transparent portfolio experience

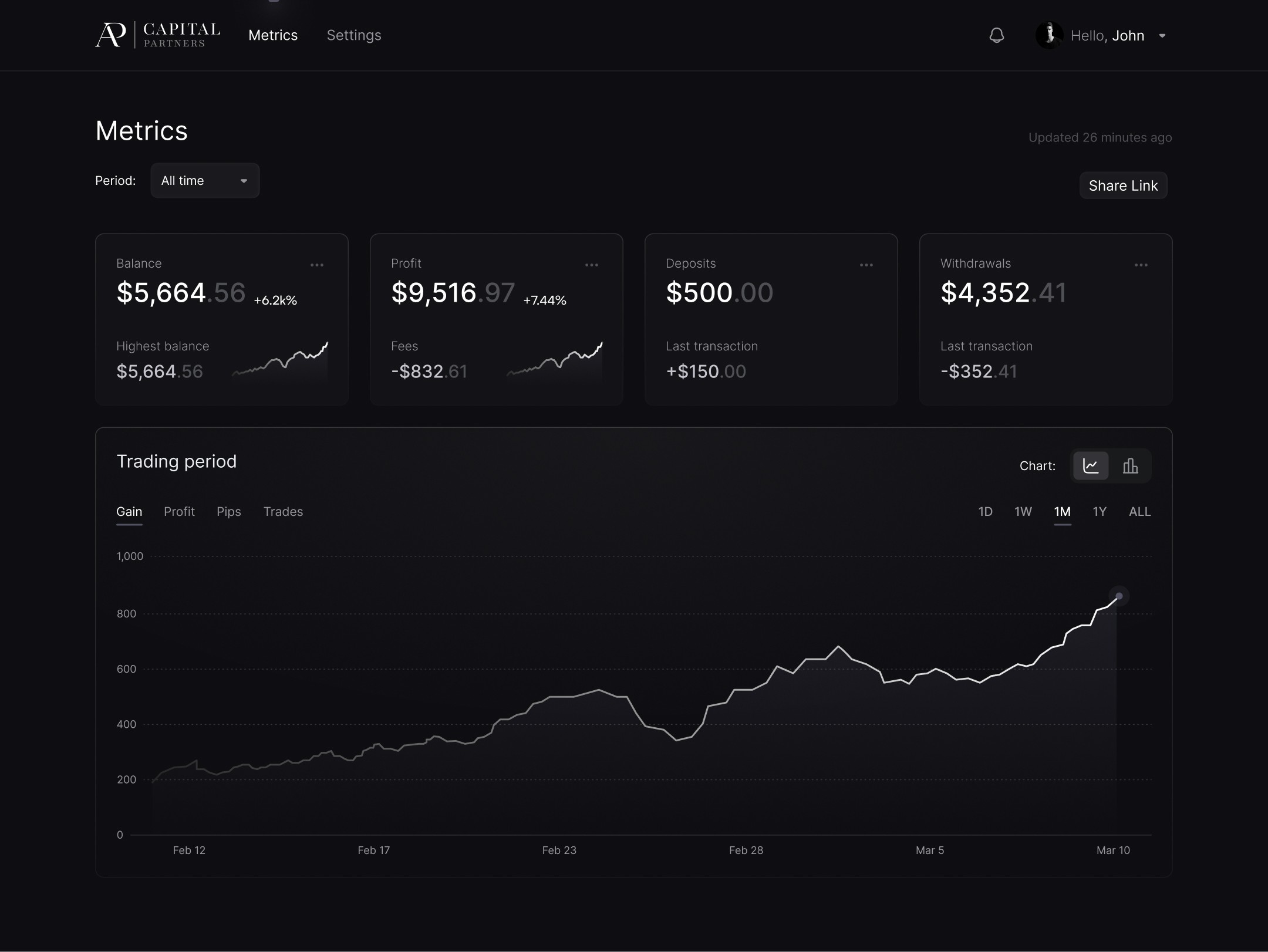

Monitor holdings, performance, and risk metrics in real time; across multiple strategies. Built for high-net-worth individuals and businesses who value control, transparency, and clear insights into their holdings. These tools provide enhanced visibility, but risks remain and outcomes cannot be guaranteed.

*at FCA-regulated partner

Over the past five years, our portfolio strategies have delivered an average annual return of 43%. Traditional assets or hedge funds like Citadel (23%) the S&P 500 (19%), Gold (13.9%), MSCI World (13.1%).

*Returns reflect the average annual performance of AP Capital Partner’s facilitated strategies over the past five years. Past performance is not indicative of future results.

Our analytical framework is built on years of research into market behavior, sentiment flows, and systemic inefficiencies, not headlines or human instinct. Rather than predicting markets, our models identify and respond to recurring patterns with precision, using tested methodologies and strict risk parameters to reduce exposure and improve consistency over time. The result is a repeatable, data-driven process that removes emotion and subjectivity, empowering individuals and businesses with clear, evidence-based insights for informed decision-making.

Step 1:

Open a PU Prime account

Create a personal trading account with our partner broker, PU Prime. It is essential to complete this via the provided link. This account will be held in your name, giving you full control and transparency over your funds.

Step 2:

Open a PAMM account

Based on how many strategies you want to use, open the corresponding number of accounts. Each strategy requires a separate account.

Step 3:

Account verification & Deposit of funds

Complete your account verification to ensure full access to deposit and withdrawal features

Step 4:

Signing the Risk Mandate & Suitability Test

You are about to be redirected to our regulated compliance partner. You will be asked to sign a risk mandate, facilitated in cooperation with our regulated compliance partner. This mandatory compliance step is required before you can connect to any PAMM account under the AP Capital Partners' strategy.

Step 5:

Connect to the PAMM

Link your account or accounts to one or more AP Capital Partners strategies after signing the risk mandate with our regulated compliance partner. This allows AP Capital Partners to facilitate the trading strategies.

Step 6:

Download the AP Capital Partners' app

The AP Capital Partners' app is available on the Apple App Store. For a more comprehensive overview, clients can visit their Personal Dashboard on desktop.